- TO:

- ALL FAMILY SUPPORT DIVISION OFFICES

- FROM:

- ALYSON CAMPBELL, DIRECTOR

- SUBJECT:

- INCOME VERIFICATION FOR MODIFIED ADJUSTED GROSS INCOME (MAGI) PROGRAMS

- MANUAL REVISION #29:

1805.010.20

1805.010.20.05

1805.010.20.10

1805.010.20.15

1805.010.20.20

1805.010.25

DISCUSSION:

The purpose of this memorandum is to introduce the addition of Missouri Employment Security data in the Missouri Eligibility Determination and Enrollment System (MEDES), and income verification requirements when determining eligibility for MAGI programs at time of application, review, and at any other time necessary to determine continued eligibility. The division must verify all eligibility factors through available means, including information obtained through the electronic data hub, a participant’s statement (attestation), or other information the division has obtained.

NOTE: Income verification requirements for other Family Support Division programs have not changed.

When determining income amounts, it is necessary to calculate the most accurate projection possible of the household's gross monthly income. Verification and comments on the case must support, to the greatest extent possible, that all sources of income have been identified, and that the budgeted amounts are accurate.

Available resources must be used in the following order prior to requesting verification from the applicant/participant:

- The Federal Hub (this source must always be used first)

- The Work Number

- IMES, IIVE, or Child Support Payment Information

- Quarterly Wage Matches

- New Hire Matches

- Income verified for any other FSD program within the last six (6) months.

NOTE: New Hire Matches can only be used as income verification if the participant has reported the source of income, and the information is reasonably compatible. If the participant has not reported the income source, and an additional electronic data source supports the employment, contact the participant for clarification.

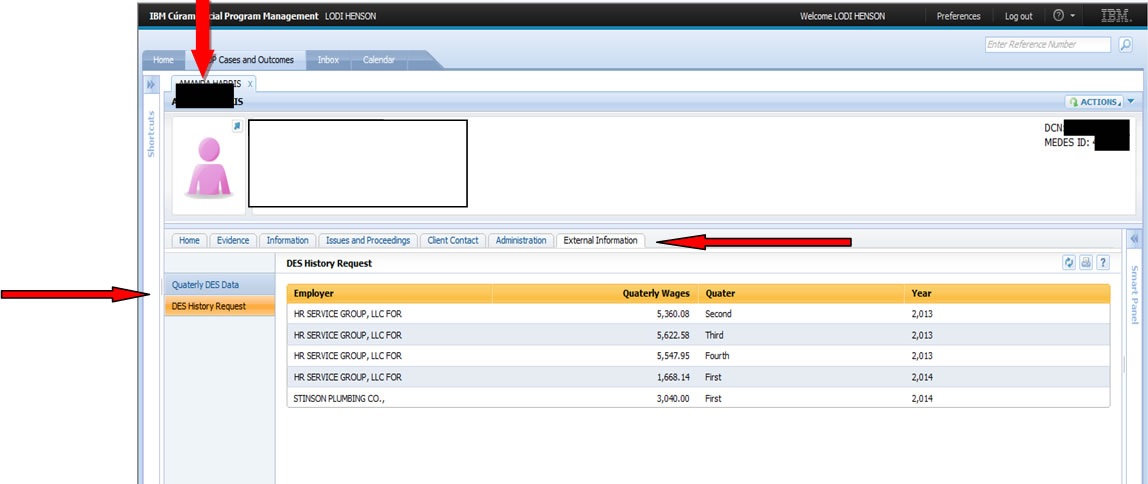

Division of Employment Security (DES) Data in MEDES

MEDES interfaces with the Department Of Labor and Industrial Relations (DOLIR)/ Division of Employment Security and provides two types of data:

- Quarterly DES Data

- DES History Request

NOTE: This data is also available through the IMES Screen. The process of printing and scanning the IMES screen to the Virtual File Room has not changed. Staff is instructed to continue this procedure until further notice.

The eligibility specialist can access this information from the “person” page under the “External Information” tab.

Reasonable Compatibility

Income information is reasonably compatible if the participant statement and data obtained through an electronic source, or income verified by another FSD program in the last six (6) months show:

- The income amounts are

- Above the applicable income standard or other relevant income threshold, (ineligible), or

- At or below the applicable income standard or other relevant income threshold (eligible),

Or

- The difference between the sources of the income information is ten percent (10%) or less and the sources of income are similar.

If the participant’s statement is reasonably compatible with information obtained through the federal data hub, other electronic data sources, or income verified for any other FSD program within the last 6 months, use the statement provided by the participant (no additional verification is required).

If reasonably compatible standards are not met, secondary verification is required. Secondary verification may include the following:

- Other electronic data sources available;

- Other information, including paper documentation; or

- A written statement which reasonably explains the discrepancy

EXAMPLE 1: Charles has applied for MO HealthNet for Families for himself and his two children. Individual self-attestation of income is below the MAGI eligibility level.

Electronic data sources show that Charles’ income is below the MAGI eligibility level:

- Eligibility level = 148% FPL

- Self-attested current income = 115% FPL (only reports income from work)

- IMES data = 130% FPL

Determination: Charles is not eligible for coverage but his two children are determined eligible for MO HealthNet non-CHIP coverage. The information received from the electronic data sources and the self-attested information are both below the MO HealthNet non-CHIP eligibility level.

EXAMPLE 2: Betty has applied for MO HealthNet for Families for her three children (all over the age of one).Individual self-attestation of income is above the MAGI eligibility level.

Electronic data sources show that Betty’s income is above the MAGI eligibility:

- Eligibility level = 148% FPL

- Self-attested current income = 160% FPL

- IRS data = 180% FPL

- Quarterly Wage report (past 3 months) = 165% FPL

Determination: The self-attested income and the information from the electronic data sources are all above the MAGI eligibility level, so Betty’s children are ineligible for MO HealthNet non-CHIP coverage. Since reasonably compatible standards are not met, secondary verification is required and the household will be screened for CHIP eligibility.

EXAMPLE 3: Sophie has applied for MO HealthNet for Families for one child.

Individual self-attestation of income is below the MAGI eligibility level. Electronic data sources show that Sophie’s income is above the MAGI eligibility level

- Eligibility level = 148% FPL

- Self-attested current income = 147% FPL

- IRS data = 156% FPL

- Quarterly Wage report (past 3 months) = 153% FPL

Determination: Data is not consistent so the ES must apply the reasonable compatibility standard.

- If the difference between the self-attested income and the electronic data source income is less than 10% the data is reasonably compatible. Sophie’s child is eligible for MO HealthNet non-CHIP coverage. If the income had not been reasonably compatible, the ES would move to option 2.

- Request an explanation of the discrepancy. If reasonable, for example Sophie recently had her hours cut, determine the child eligible for MO HealthNet non-CHIP. If not reasonable move to option 3.

- Request verification from Sophie.

EXAMPLE 4: James is age 18 and applying for MO HealthNet for Families for himself. Individual self-attestation of income is above the MAGI eligibility level. Electronic data sources show that James’ income is below the MAGI eligibility level:

- Eligibility level = 148% FPL

- Self-attested current income = 160% FPL

- IRS data = 140% FPL

- Quarterly Wage report (past 3 months) = 125% FPL

Determination: Self attested income is above the MO HealthNet non-CHIP limit but the electronic data sources are below. The difference between the self attested income and the electronic data source income is more than 10%. Inform James of the discrepancy and ask him to clarify his statement of income before determining him ineligible for MO HealthNet non-CHIP coverage and screening him for MO HealthNet CHIP coverage.

Earned Income

To determine eligibility, verify earned income. The participant must provide permission to access the federal data hub. If verification cannot be obtained through the federal data hub, and verification is available through other electronic sources, use these sources to verify the earned income.

Income verification received for any Family Support Division (FSD) program within the past six (6) months prior to a MO HealthNet application date or receipt date of an annual review may be used for the MO HealthNet application. When calculating the last six (6) months go by the date the agency received the documentation, not the date the applicant received the pay. This income amount must be reasonably compatible with the participant’s statement.

EXAMPLE: We have a MO HealthNet review for Mary. Today is August 1. Mary applied and was approved for Food Stamps on April 28. Since information is not available through the Federal Data Hub or any other electronic sources, we can use the information from Mary’s Food Stamp case as long as it is reasonably compatible with her current statement of income. Mary’s current statement of income will be entered in MEDES.

If all above resources are exhausted, verification must be requested from the applicant or active household. It is required to have them provide one of the following:

- At least 30 days of current pay stubs

- Most recent income tax return

- Signed and dated statement from employer

There may be instances when you are unable to obtain any verification other than the participant’s statement. In these instances, consult your office management and determine if you should accept the participant statement without a second source of verification. Thoroughly document the basis for the decision in the comments.

Unearned Income

To determine eligibility, verify unearned income. The participant must provide permission to access the federal data hub. If verification cannot be obtained through the federal data hub, and information is available through other electronic data sources, use these sources to verify the unearned income. Examples of electronic data sources include, but are not limited to:

- IMES to verify Unemployment Compensation;

- IIVE to verify Social Security and/or Supplemental Security Income; and

- Child Support Payment Information

If information is unavailable through these sources, you may look at verification received for any Family Support Division (FSD) program within the last six (6) months. Explore reasonable compatibility between the electronic data source and the participant’s statement.

If all above resources are exhausted, verification must be requested from the applicant or active household. It is required to have them provide one of the following:

- Award letter

- Signed and dated statement from the source of income

There may be instances when you are unable to obtain any verification other than the participant’s statement. In these instances, consult your office management and determine if you should accept the participant statement without a second source of income.

Excluded Income

All sources of income must be entered into MEDES including excluded income. Participant statement is acceptable for verification of excluded income, however, if an electronic data source is available, employ reasonable compatibility guidelines.

Comments

Comments must be entered in the Missouri Eligibility Determination and Enrollment System (MEDES) detailing how the income was verified. Comments should be placed on the Application or Integrated Case under Evidence. Click on the green action arrow for the specific evidence you are verifying and select “EDIT”.

Record any information regarding income source, reason ended, or any information pertinent to your calculation of income that requires further explanation. Include percentage for reasonable compatibility (if appropriate). Record any information regarding the income amount and how that was determined.

NECESSARY ACTIONS:

- Review this memorandum with appropriate staff.

- Enter complete comments in MEDES, including what source(s) of income were used, and how reasonable compatibility was used.

- Continue to print and scan IMES to the Virtual File Room.

- Implement changes immediately.

AC/df/lh