- TO:

- FAMILY SUPPORT DIVISION OFFICES

- FROM:

- JULIE GIBSON, DIRECTOR

- SUBJECT:

- BUDGETING NEGATIVE SELF-EMPLOYMENT INCOME (LOSSES) FOR PROGRAMS SUBJECT TO MODIFIED ADJUSTED GROSS INCOME METHODOLOGY

- MANUAL REVISIONS #35

1805.030.25.15 Specific Types of Income

DISCUSSION:

This memorandum clarifies budgeting Self-Employment (SE) negative income (losses) for programs subject to Modified Adjusted Gross Income (MAGI) methodology. This memorandum also introduces an update to the MAGI Family Healthcare manual section 1805.030.25.15 Specific Types of Income SELF-EMPLOYMENT INCOME.

This memorandum includes:

- Clarification of Negative Self-Employment Income and Losses;

- Sources of Income that can be shown as a Negative Amount on the IRS-1040;

- Entering Negative Self-Employment Income in the Missouri Eligibility Determinations and Enrollment System (MEDES); and

- Examples of how Negative Income affects the Household (HH) Budget.

Clarification of Negative Self-Employment Income and Losses

13 CSR 40.7.030 states that MAGI based income means income calculated using the same financial methodologies used to determine MAGI as defined in section 36B (d)(2)(B) of the Internal Revenue Code, with exceptions. As the Internal Revenue Service (IRS) allows negative SE income, or losses, to be used to offset other income, the FSD will allow negative SE income or losses to be used in determining the HH MAGI budget.

Sources of Income that can be shown as a Negative Amount on the IRS-1040

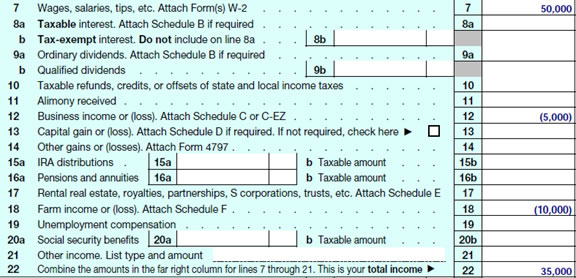

Negative income amounts are listed in parenthesis () and appear in the Income section of the IRS-1040 (lines 7 through 21). Lines 12, 13, 14, 17, 18, and 22 may contain negative amounts.

- The most common area to see a negative income, or loss, is on line 12 of the IRS-1040 (Self-Employment). This line is listed as Business income or (loss), Attach Schedule C or C-EZ. A negative income, or loss, will show in parenthesis () at the end of line 12.

- Capital gain or (loss) is listed on line 13 of the IRS-1040. A negative income, or loss, will show in parenthesis () at the end of line 13.

- Other gains or (losses) are listed on line 14 of the IRS-1040. This is defined as sold or exchanged assets used in trade or business. A negative income, or loss, will show in parenthesis () at the end of line 14.

- Rental real estate, royalties, partnerships, S corporations, trusts, etc. are listed on line 17 of the IRS-1040. A negative income, or loss, will show in parenthesis () at the end of line 17.

- Farm income or (loss) is listed on line 18 of the IRS-1040. A negative income, or loss, will show in parenthesis () at the end of line 18.

- Line 22 is the sum total of lines 7 through 21including negative income.

Listed below is an example of an IRS-1040 with wages of $50,000 annually. The household has a loss of $5,000 on line 12 (SE) and a negative income, or loss, of $10,000 on line 18 (Farm Income). The total HH income is $35,000.

Entering Negative Self-Employment Income in the Missouri Eligibility Determination and Enrollment System (MEDES)

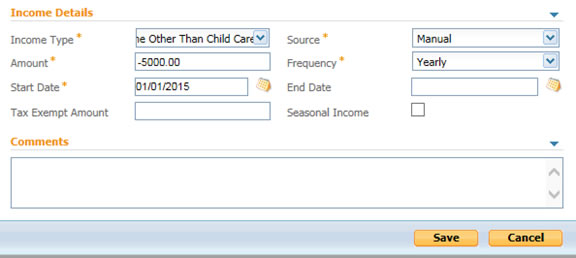

At this time, MEDES will not allow a negative income amount, or loss, to be entered by staff when entering applications through the caseworker portal. Once the application is submitted the income evidence is updated to show as a negative amount, or loss, at the application case level. Income evidence may also be updated at the Integrated Case level for active cases.

To show income as a negative, or loss, in MEDES the income amount must be preceded by a negative sign (-). Negative SE income, or loss, of $5,000 would be entered into MEDES as Income Type Net Self-Employment Income Other Than Child Care. Amount -5000.00 (see below).

Examples of how Negative Income affects the Household (HH) Budget

The following are examples of how various types of negative income, or loss, affects the HH budget:

- A mother has wages of $25,000 annually. Her husband has a SE business and it had a loss of $5,000 for the year. This is reported on line 12 of the IRS-1040. They are applying for their 2 children and claim them as tax dependents. The HH of 4 will have an annual income of $20,000 ($25,000 minus $5,000 equals $20,000 annual HH income).

- A mother and father have a Partnership and report a $2,000 loss on their tax return. This is reported on line 17 of the IRS-1040. They are applying for coverage for their 18yr old child. Their child has $13,000 in annual income. He will file his own return, but will be claimed as a dependent of the filing parents. The HH will have an annual income of $11,000 ($13,000 minus $2,000 equals $11,000 annual HH income).

NOTE: In this scenario the child’s income is countable towards the HH as he is required to file a tax return. His parent’s partnership negative income, or loss, offsets his income in determining MAGI for the HH.

NECESSARY ACTION:

- Review this memorandum with appropriate staff.

- Effective immediately, begin using updated policy pertaining to the budgeting of negative Self-Employment and income losses for programs subject to MAGI methodology.

JG/ns