- TO:

- ALL FAMILY SUPPORT DIVISION OFFICES

- FROM:

- JULIE GIBSON, DIRECTOR

- SUBJECT:

- ACHIEVING A BETTER LIFE EXPERIENCE (ABLE) ACCOUNTS FOR THE MO HEALTHNET, FOOD STAMP, TEMPORARY ASSISTANCE, AND CHILD CARE SUBSIDY PROGRAMS

- MANUAL ADDITION #44

- 1025.015.17

1115.035.15.16 - MANUAL REVISION #44

- 1060.005.20

0805.015.10

0410.015.15

0610.010.00

1110.020.40

1115.015.90

0210.015.35.50

1210.025.10.30

DISCUSSION:

The purpose of this memorandum is to introduce Achieving Better Life Experience (ABLE) accounts and the impact of an ABLE account on federally funded, means-tested programs.

This memorandum discusses the following:

- LEGAL BASIS FOR AN ABLE ACCOUNT

- QUALIFIED ABLE PROGRAM

- QUALIFIED ABLE ACCOUNT

- ELIGIBLE INDIVIDUALS

- IMPACT ON ELIGIBILITY FOR MO HEALTHNET, FOOD STAMPS, TEMPORARY ASSISTANCE AND CHILD CARE SUBSIDY

- QUALIFIED DISABILITY EXPENSES

- SUSPENDED SUPPLEMENTAL SECURITY INCOME (SSI) BENEFITS

- ESTATE RECOVERY

- FAMILY ASSISTANCE MAINTENANCE INFORMATION SYSTEM (FAMIS) PROGRAMMING CHANGES

LEGAL BASIS FOR AN ABLE ACCOUNT

The Tax Increase Prevention Act of 2014 became Public Law No: 113-295 on December 19, 2014. This law includes:

Division B: Achieving A Better Life Experience Act of 2014 -Stephen Beck, Jr., Achieving a Better Life Experience Act of 2014 or the Stephen Beck, Jr., ABLE Act of 2014 – Title I: Qualified ABLE Programs –

(Sec. 101) States as the purposes of this title to:

(1) encourage and assist individuals and families in saving private funds for the purpose of supporting individuals with disabilities to maintain their health, independence, and quality of life; and

(2) provide secure funding for disability-related expenses of beneficiaries with disabilities that will supplement, but not supplant, benefits provided through private insurance, title XVI (Supplemental Security Income) and title XIX (Medicaid) of the Social Security Act, the beneficiary's employment, and other sources.

(Sec. 102) Amends the Internal Revenue Code Section 529 to exempt from taxation a qualified ABLE program established and maintained by a state, or by an agency or instrumentality of the state, to pay the qualified disability expenses related to the blindness or disability of a program beneficiary, including expenses for education, housing, transportation, employment training and support, assistive technology and personal support services, health, prevention and wellness, financial management and administrative services, legal fees, expenses for oversight and monitoring, and funeral and burial expenses.

(Sec. 103) Requires amounts in ABLE accounts to be disregarded in determining eligibility for means-tested federal programs, except distributions for housing expenses under the Supplemental Security Income (SSI) program, and for amounts in an ABLE account exceeding $100,000 under SSI.

Suspends the payment of SSI benefits to an individual, during any period in which such individual has excess resources in an ABLE account, but does not suspend or affect the Medicaid eligibility of such individual.

Missouri Senate Bill 174 amended Chapter 166 RSMo to create the Missouri Achieving a Better Life Experience (ABLE) Program effective August 28, 2015.

QUALIFIED ABLE PROGRAM

A qualified ABLE program is an ABLE program established and maintained by the Missouri ABLE board or another state’s ABLE board.

QUALIFIED ABLE ACCOUNT

A qualified ABLE account is an account established under the Missouri ABLE Program or another state’s qualifying program for an eligible individual. An eligible individual may have only one ABLE account.

ELIGIBLE INDIVDUALS

Individuals who became disabled or blind prior to his or her 26th birthday, and are receiving Social Security Disability (SSDI) or Supplemental Security Income (SSI), or who are considered disabled by a qualified ABLE program may establish an ABLE account. Eligible individuals who own an ABLE account are referred to as designated beneficiaries of the account.

IMPACT ON ELIGIBILITY FOR MO HEALTHNET, FOOD STAMPS, TEMPORARY ASSISTANCE AND CHILD CARE SUBSIDY

Contributions and earnings credited to an ABLE account are not income.

ABLE account balances and distributions are disregarded in the resource and income eligibility determination for the federally funded, means-tested MO HealthNet, Food Stamp, Temporary Assistance, and Child Care Subsidy programs during any period which the participant maintains, makes contributions to, or receives distributions from the ABLE account.

QUALIFIED DISABILITY EXPENSES

Qualified disability expenses are any expenses related to the eligible individual's blindness or disability including the following: education, housing, transportation, employment training and support, assistive technology and personal support services, health, prevention and wellness, financial management and administrative services, legal fees, expenses for oversight and monitoring, and funeral and burial expenses. Qualified disability expenses may include basic living expenses and are not limited to items for which there is a medical necessity or which solely benefit a disabled individual.

Any expenses incurred at a time when a designated beneficiary does not meet the definition of eligible individual are not qualified disability expenses.

NOTE: Medical expenses paid with funds from an ABLE account cannot be used to meet spend down liability.

SUSPENDED SUPPLEMENTAL SECURITY INCOME (SSI) BENEFITS

If an SSI recipient’s benefits are suspended because the balance in the ABLE account exceeds $100,000, for purposes of MO HealthNet treat the individual as if they continue to receive payment of SSI benefits. Do not require the individual to be determined disabled by the Medical Review Team (MRT).

ESTATE RECOVERY

A portion or all of the balance remaining in the ABLE account of a deceased designated beneficiary shall be paid to the state of Missouri, or other states with a claim, for benefits provided to the designated beneficiary under MO HealthNet or another state's Medicaid plan. The payment of the state of Missouri MO HealthNet claim and any other state’s clam shall be made after payment of all outstanding qualified disability expenses are satisfied. The payment will be limited to the amount of the total medical assistance paid for the designated beneficiary after the establishment of the ABLE account.

FAMILY ASSISTANCE MANAGEMENT INFORMATION SYSTEM (FAMIS) PROGRAMMING CHANGES

Effective August 28, 2015, programming changes are made to the Family Assistance Management Information System (FAMIS) allowing entry of ABLE accounts as resources and ABLE account distributions as income.

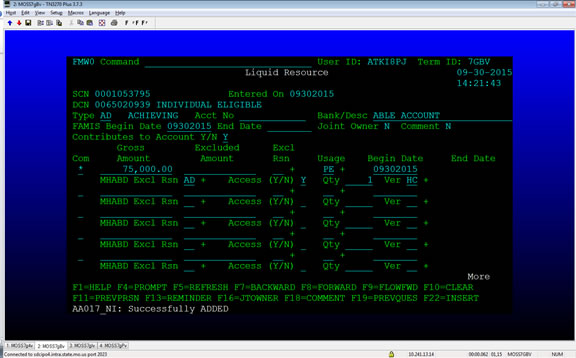

A new resource code type has been added to the Liquid Resource (FMW0) screen. This type code is ACHIEVING BETTER LIFE EXPERIENCE (ABLE) PGM (AD).

FAMIS is coded to exclude the ABLE account as a resource for the Food Stamp, Temporary Assistance, and Child Care Subsidy programs. FAMIS is coded to require a MHABD exclusion reason for MO HealthNet cases.

A new MHABD exclusion reason has been added to the Liquid Resource (FMW0) screen. This exclusion reason code is ACHIEVING BETTER LIFE EXPERIENCE (ABLE) PGM (AD). See the FAMIS User Guide EXCLUDING A LIQUID, VEHICLE, PERSONAL AND REAL PROPERTY, LIFE INSURANCE AND BURIAL POLICY AS A RESOURCE FOR MHABD for information about excluding a resource for MHABD cases.

FAMIS does not complete a resource eligibility test for Child Care Subsidy cases. There is no change in policy or programming regarding resources for Child Care Subsidy cases.

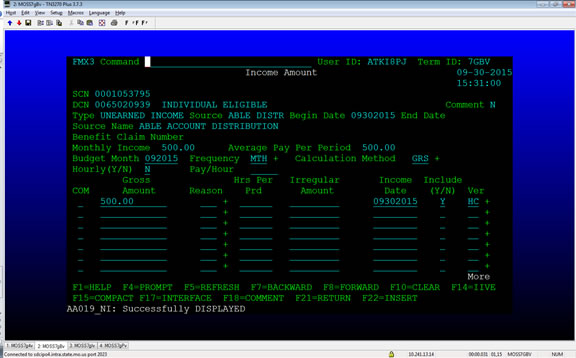

A new income source code has been added on the Income (FMX0) screen. This source code is ACHIEVING BETTER LIFE EXPERIENCE (ABLE) PGM (AD).

FAMIS is coded to exclude AD income sources in the eligibility determination for all programs.

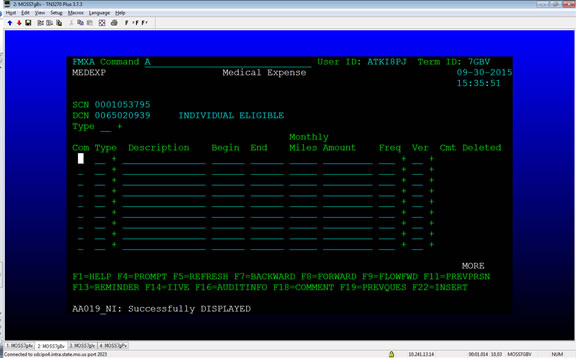

The Medical Expense (MEDEXP, FMXA) screen continues to be used to enter medical expenses. There has been no change to this screen.

Do not enter any medical expenses on the Medical Expense (MEDEXP, FMXA) screen paid for with funds from an ABLE account.

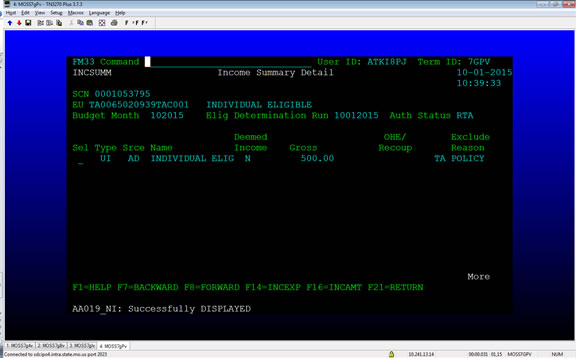

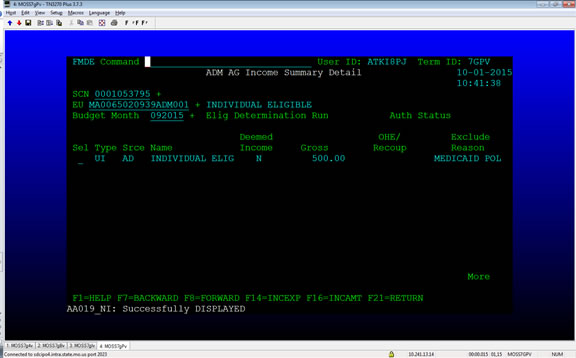

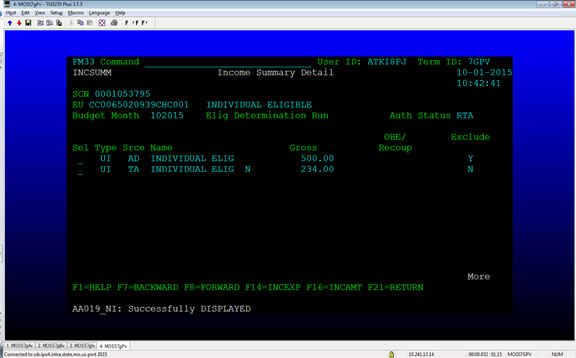

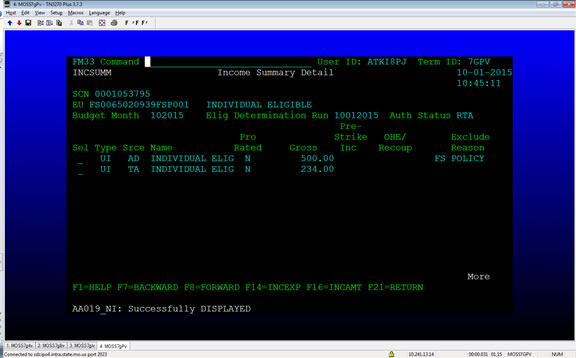

The Income Summary Detail (INCSUMM, FM33) for each program will show the ABLE account distribution as excluded income.

Temporary Assistance:

MO HealthNet for Aged, Blind, and Disabled:

Child Care Subsidy:

Food Stamps:

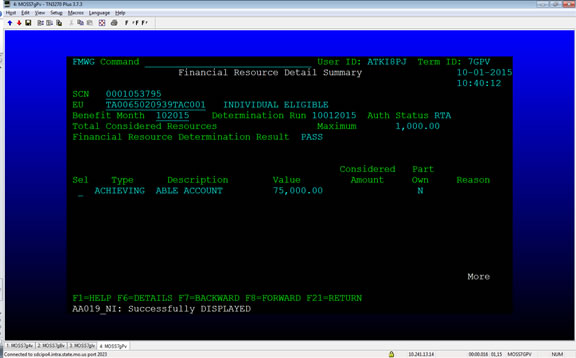

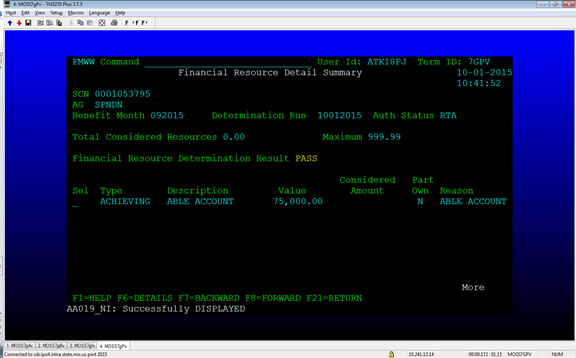

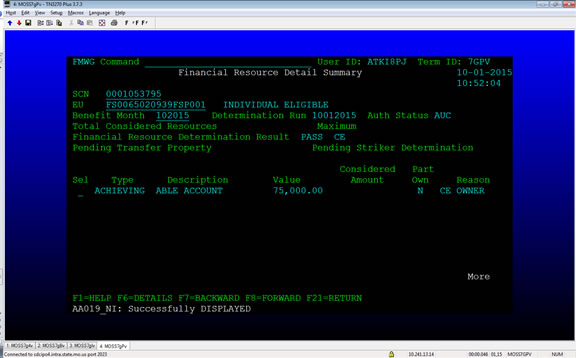

The Financial Resource Detail Summary (FMWG) screen will show the ABLE account as an excluded resource for Temporary Assistance, MO HealthNet for Aged, Blind and Disabled and Food Stamp cases.

Temporary Assistance:

MO HealthNet for Aged, Blind, and Disabled:

Food Stamps:

NECESSARY ACTION:

- Review this memorandum with appropriate staff

JG/JO/HA