- TO:

- ALL COUNTY OFFICES

- FROM:

- ALYSON CAMPBELL, DIRECTOR

- SUBJECT:

- DISQUALIFIED OR INELIGIBLE MEMBERS EARNED INCOME AND EXPENSE BUDGETING FOR THE FOOD STAMP PROGRAM

-

MANUAL REVISION #19

1115.035.20.05

1115.070.00

1115.071.00

DISCUSSION:

The purpose of this memorandum is to introduce revised policy for budgeting disqualified or ineligible member's income and/or child support exclusion to the remaining eligibility unit (EU) members. Food Stamp Policy Manual section 1115.070.00 Income from Disqualified Members has been revised and divided into two sections. This memorandum addresses the following:

- DISQUALIFIED OR INELIGIBLE MEMBERS

- CLARIFICATIONS AND SCREEN CHANGES

- FAMIS SYSTEM ADJUSTMENT

- NOTICES

- FAIR HEARING REQUEST

Disqualified or Ineligible Members

This change affects disqualified or ineligible members whose income is prorated. Following are the types of disqualified or ineligible members whose income is prorated:

- persons who fail to obtain or refuse to provide an SSN,

- persons ineligible due to immigration status (not meeting the criteria of qualified and eligible immigrant, including temporary and undocumented immigrants),

- persons subject to and not meeting the 18 to 50 year old work requirement for able-bodied adults without dependents (ABAWDs), or

- persons with a comparable disqualification for failure to comply with a required action for a means-tested public assistance program.

Clarifications and Screen Changes

Earned Income Deduction

Previously these disqualified or ineligible members were given a 20% Earned Income Deduction (EID) prior to prorating their income for the household. Due to a clarification received from Food and Nutrition Services (FNS) disqualified or ineligible member budgeting is changed as follows:

- Gross earned income of a disqualified or ineligible eligibility unit (EU) member is prorated by the total number of EU members prior to deducting the 20% EID. Apply the EID as follows:

EXAMPLE: A family of four applies for Food Stamp benefits. The ineligible EU member has $1,200 monthly earned income. The ineligible member pays the rent of $400 per month and the utilities. Therefore, the household is eligible for the standard utility allowance (SUA) of $288.00.

Ineligible member's earned income |

$1200 |

Divided by a 04 person EU multiplied by 03 eligible EU members $1200/4 = $300 x 3 = $900 Compare to 130% of poverty for a 03 person EU ($2069) |

$900 |

If eligible on 130% of poverty, subtract the 20% EID $900 x 20% = 180 |

-$180 |

Total unearned income budgeted to the Food Stamp EU |

$720 |

Standard Deduction for a 03 person EU |

-$149 |

Adjusted EU income |

$571 |

Total shelter expense allowed to the 03 eligible EU members Adjusted income of $571/2=$285.50 –prorated rent $300 and full SUA $288 = |

-$302.50 |

Net income for 03 person EU |

$268.50 |

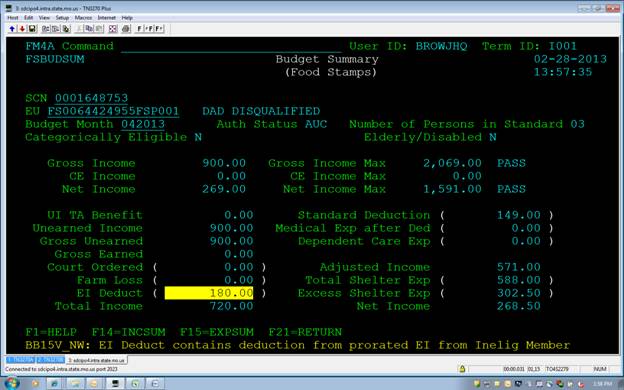

The FAMIS budget process while in the controlled flow or maintenance does the calculation and prorates the income and expenses. When viewing a budget on the Food Stamp Budget Summary (FM4A/FSBUDSUM) that contains a disqualified or ineligible member with earned income, the 20% EID will be shown in the EI deduction field highlighted in yellow with the message "EI Deduct contains deduction from prorated EI from Inelig Member." See screen print using above example:

Child Support Exclusion

Previously any child support exclusion was applied to the EU member who paid the child support. This policy is changed per clarification from the FNS:

- When prorating ineligible or disqualified members' income, all obligated child support paid by eligible and/or ineligible EU members is excluded from the household's gross income. Apply the child support exclusion as follows:

- Total the amount of the child support paid by all EU members to someone outside the household.

- Deduct the total from the disqualified or ineligible EU member's gross income.

- Deduct any remaining child support from the eligible EU members' income.

EXAMPLE: Family of 3 applies for Food Stamps benefits. The ineligible EU member has $1200 earned income and is obligated and pays $300 in child support to someone outside the household. An eligible EU member also has a $75 obligation and pays child support to someone outside the household.

Ineligible member's earned income |

$1200 |

Minus total EU child support paid $300 + $75 = $375 $1200 - $375 = 825 |

$825 |

Divided by a 03 person EU multiplied by 02 eligible EU members 825/3 = 275 X 2 = $550 compare to 130% of poverty for a 02 person EU ($1640) |

$550 |

Total unearned income budgeted to the Food Stamp EU |

$550 |

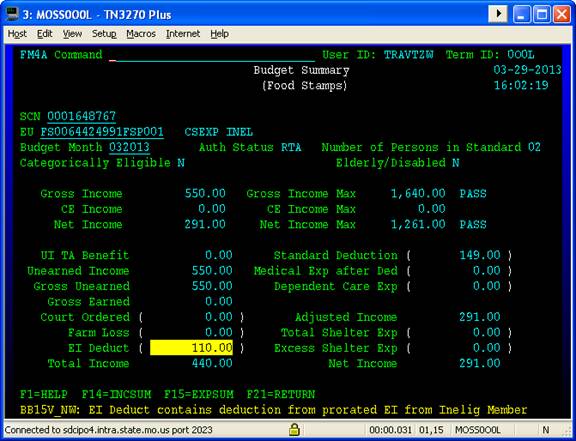

When viewing a budget on the Food Stamp Budget Summary (FM4A/FSBUDSUM) that contains an EU member with obligated and paid child support, the screen will only show the amount of child support deducted from the eligible EU members. The screen print from example above shows no child support exclusion because it was all deducted from the ineligible member's income:

EXAMPLE: Family of 3 applies for Food Stamps benefits. The ineligible EU member has $300 earned income and is obligated and pays $300 in child support to someone outside the household. An eligible EU member has $600 earned income and is obligated and pays $75 child support to someone outside the household.

Ineligible member's earned income |

$300 |

Minus total EU child support paid of $300 + $75 = $375 $300 - $375 = - $75 |

($75)* |

Total unearned income budgeted to the Food Stamp EU |

$0 |

Eligible EU member's gross earned income |

$600 |

*Minus remaining child support paid |

- $75 |

Eligibility Units adjusted gross income |

$525 |

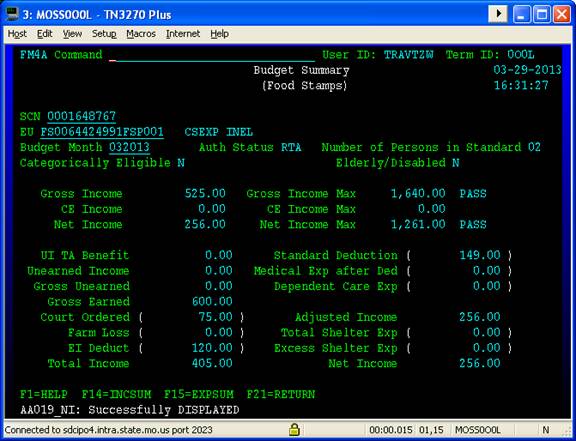

The screen print from this example shows the $75 child support exclusion, but does not show the $300 child support deducted from the ineligible members income:

The Worker Initiated Budget Calculation Area (WIBCA) process does not complete the calculation to prorate the income and/or expense. When completing a WIBCA for an EU that contains ineligible or disqualified members, the calculation of the prorated income and expenses must be done offline. Then, the prorated income and expenses are entered into the WIBCA budget. Always enter comments on WIBCAs to thoroughly explain how the calculations were made. For further instructions on manually calculating income and expenses refer to the IM Chart MANUALLY CALCULATING A FOOD STAMP BUDGET.

FAMIS System Adjustment

This change will be in effect March 18, 2013. Eligibility determinations ran on a case this date will be determined using the new budget calculations. An adjustment for all active cases will be completed in FAMIS the evening of March 18, 2013. This will not require action from the Eligibility Specialist.

Notices

All EUs with an allotment that increases or has no change are sent an FA-150 Action Notice. The notices are dated March 19, 2013. The reason field on the Action Authorization (FM3H) screen displays IIL – INELIGIBLE PERSON INCOME CALCULATION ADJUSTMNT (system) for the adjustment. To inquire why an action is taken, on the EU Action Log (EULOG/FM40) screen, select the action, and press F17=INQAUTH. The Action Authorization (FM3H) screen appears. Press F19=REASON. The reason code and the code description appear.

EUs with cases that are closing or with an allotment decrease will receive an FA-510 Adverse Action Notice dated March 19, 2013, for changes effective for April, 2013.

Staff may view the notices on the Document Queue (DOCQUE/FMVM) screen.

Fair Hearing Requests

If the EU requests a fair hearing for the Food Stamp Program, the IM-87 and the Action Notice are scanned to a file and e-mailed to the Administrative Hearing Unit (AHU) Regional Office. The original, completed IM-87 is retained in the claimant's case file. The scanned file must be e-mailed to the AHU that serves the claimant's residence county as soon as possible, but no later than the close of business on the next working day following receipt of the hearing request.

FSD must ensure that agency exhibits are submitted to the Administrative Hearing Unit no later than seven calendar days following the submission of the IM-87 hearing request. All available evidence should be sent to the Hearing Unit.

The fair hearing evidence due to the adjustment may include but is not limited to, these items:

- FA-510 Adverse Action Notice

NOTE: When a fair hearing is requested while an FA-510 adverse action is pending, the EU has the option to continue to receive the current level of benefits pending the hearing results. If the EU chooses to continue receiving benefits at the current level, the pending adverse action is placed on hold (HOL). To place an adverse action on hold due to a hearing request follow instructions found in User Guide Changing An Adverse Action Status.

- FA-150 Claimant Action Notice

- Comments Screens

- Manual sections/legal references/memorandum

- Budget Summary (FSBUDSUM/FM4A) screen for applicable months

- Detail screens of budget entries, as applicable:

- Income Summary Detail (INCSUMM/FM33)

- Expense Summary (FM34)

- Income (FMX0) screen

- Income Amount (FMX3) screen

- Shelter Expense (SHELEXP/FMXK) screen

- Court Ordered Expense (SUPEXP/FMXL) screen

- Dependent Care Expenses (DCEXP/FMXM) screen

- Medical Expense (MEDEXP/FMXA) screen

NOTE: Part of the budget calculations for these EU's is not shown on the Food Stamp Budget Summary (FSBUDSUMM/FM4A) screen. The staff person conducting the hearing must be able to explain the budget and how the calculation of income to the household was determined. If you need assistance in determining how the budget calculation was done contact the Food Stamp Program and Policy Unit prior to the hearing at ColeFSPolicy@dss.mo.gov.

- Financial Resource Detail Summary (FMWG) for applicable months if the change/closing is due to resources

- Details screens for resources, as applicable:

- Liquid Resource (FMW0) screen

- Prepaid Burial (FMW1) screen

- Personal Property (FMW2) screen

- Real Property (FMW4) screen

- Other screens as applicable for the change/closing

- Verifications

NOTE: If taking actions on cumulative changes, it is necessary to include notices and budgets from the previous actions.

Hold a pre-hearing conference. Provide a copy of the evidence to the EU asking for the hearing, and their legal representative. If the EU designates an attorney or authorized representative for the hearing, send a copy of all notices and evidence for the hearing to the EU and to the designated individual.

NECESSARY ACTION:

- Review this memorandum with appropriate staff.

AC/ks/cb