IM-146 December 16, 2022; IM-96 July 11, 2022; IM-14 March 8, 2021; IM-92 June 18, 2020; IM-147 September 27, 2019; IM-103 July 22, 2019; IM-164 December 27, 2017; IM-94 July 13, 2017; IM-50 May 12, 2017; IM-97 November 9, 2015

Deductions are expenses that lower taxable income. Because MAGI MO HealthNet (MHN) is based on taxable income, deductions must be incorporated in the calculation of the MAGI-based income.

Accept self-attestation for deductions allowed in the calculation of MAGI income. Enter deductions as attested by the participant. The self-attested income and deductions must be found Reasonably Compatible (RC) with electronic data sources. If the self-attested amount is not RC, request additional information. If the additional information is not provided, do not deny or reject the application or case. Determine eligibility without including the deductions.

EXAMPLE: John applied for benefits on his 10-year-old son, Brad. John claims Brad as a tax dependent and is the custodial parent. John attests to gross wages of $1038 bi-weekly. John does not attest to pre-taxed deductions. However, John provided three paystubs with his application showing pre-taxed deductions of: health insurance of $250 semi-monthly, contributions to a Health Savings Account of $47 semi-monthly and contributions to a 401(k) of $55 semi-monthly. John’s pre-taxed deductions are added to the eligibility system. All other eligibility factors were met. The application is approved with the allowable pre-taxed deductions using the frequency of semi-monthly. Eligibility determination is made on John’s gross wages minus the pre-taxed deductions.

NOTE: When the participant’s eligibility is reviewed again, the attestation of pre-taxed deductions needs to be reconsidered, unless, auto renewed.

EXAMPLE: Bill’s daughter, Mary, is currently receiving coverage under MO HealthNet for Kids non-premium (MHK). Bill claims Mary as a tax dependent and is the custodial parent. Bill is now attesting to gross wages of $1300 per month. Bill also now attesting to pre-taxed deductions: health insurance for himself of $250 per month and contributions to a 401(k) of $1,300 per year. Electronic data sources confirm and are reasonably compatible with Bill’s attestation of gross wages minus pre-taxed deductions. Therefore, Bill does NOT need to provide verification of his deductions. All other eligibility factors were met and Mary remains eligible for MHK (no change in level of care). The change is finalized. The eligibility system will determine Mary’s eligibility based on Bill’s attestation of gross wages minus his attestation of pre-taxed deductions.

NOTE: When the participant’s eligibility is reviewed again, the attestation of pre-taxed deductions needs to be reconsidered, unless, auto renewed.

EXAMPLE: Bob applied for benefits on his 11-year-old son, Steven. Bob claims Steven as a tax dependent and is the custodial parent. Bob attests to gross wages of $2,300 semi-monthly. Bob does attest to pre-taxed deductions of: health insurance of $250 semi-monthly (employee only), contributions to a Health Savings Account of $47 semi-monthly and contributions to a 401(k) of $55 semi-monthly. Electronic data sources confirms Bob’s attestation of gross wages, however, the EOI is not reasonably compatible when the pre-taxed deductions are subtracted from his gross wages. Therefore, Bob does need to provide verification of his deductions. Bob is sent an IM-31A requesting verification of his pre-taxed deductions (paystubs or employer statement). Bob fails to return the requested verification in the allotted time, therefore, his deductions are NOT allowed. All other eligibility factors were met. Steven was found ineligible for all MO HealthNet programs under MAGI because Bob’s attestation of pre-taxed deductions are not allowed and his attestation of gross wages is over the income maximum for a household of two.

NOTE: Depending on the pay frequency and the frequency of the pre-taxed deductions, the participant may have pay periods without pre-taxed deductions.

Pre-tax Deductions

Pre-tax deductions are taken out of an individual’s income before any Federal, State and local taxes are deducted and can be located on the individual’s paystubs.

- Some health insurance premiums paid by the employee

- This may include premiums paid for dental and vision, or

- Accidental health benefit premiums

- AFLAC

- Some employee contributions to 401(k) and 403(b) retirement plans

- Contributions to deferred compensation plans

- Employee contributions to a savings account for medical expenses

- Health Savings Account (HSA)

- Flexible Spending Accounts (FSA)/Cafeteria Plan

- Employee contributions to dependent care accounts

- Other uncommon Fringe Benefits Exclusions

- Meal reimbursements

- Educational Assistance

- Adoption Assistance

- Employee Discounts

- Group-term life insurance

Pre-tax deductions cannot be claimed on an individual’s tax return as this expense has already been excluded from the individual’s taxable income. Therefore, tax documents will not include verification of pre-tax deductions. Pre-tax deductions can be found on paystubs. Taxable wages can also be found in Box 1 of the most recent W-2 or taxable wages are reported on Form 1040 to determine the amount of the earnings that should be included.

- Enter in gross wages, and

- Only enter deductions allowable under MAGI guidelines

- The eligibility system will subtract the deductions from the gross income

Other Allowable Income Deductions (Adjustments to Gross Income)

In addition to pre-tax deductions, MAGI allows other income deductions which are “adjustments” to the individual’s gross income. These adjustments allow certain types of expenses to be deducted from the income after taxes are paid. Meaning, income taxes have already been paid prior to incurring these expenses. These deductions are claimed as a deduction on the Federal Income Tax Return at the end of the tax year.

These deductions can be found on IRS Schedules (1-6) form 1040. However, the individual does not have to file a tax return to get the deduction, for instance someone who is not required to file income taxes or new self-employment, therefore, the past three months of business ledgers detailing revenue and expenses is acceptable.

- Only enter deductions allowable under MAGI guidelines

- Not all schedules are applicable to MAGI guidelines

- Other types of the IRS forms that are acceptable and may replace the need for IRS Form 1040:

- IRS Form 1040-SR – U.S. tax return for seniors

- Alternative to using Form 1040

- For taxpayers age 65 or older

- Uses the same schedules and instructions as Form 1040

- 1040-X – Amended U.S. Individual Income Tax return

- Now can be filed electronically starting in tax year 2019

- Mail in option is still available

- Used to make adjustments to an already filed 1040 or 1040-SR

- IRS Form 1040-ES – Estimated Tax Payments

- IRS Form 1040-SR – U.S. tax return for seniors

NOTE: For more information on IRS forms, instructions, and publications, see irs.gov/forms-instructions.

When other allowable deductions are not reported or they are unknown, make an eligibility determination without applying the deduction. Do not deny or close an application or case for verification of deductions.

Deductions may exceed the MAGI based household income. When this occurs, the MAGI household income would be less than zero. To compare household budget to MAGI income maximums (FPL), use $0 as the MAGI household income.

NOTE: Income and deductions should be entered as reported by the individual. Allow the system to calculate the $0 budget; do not manually enter a $0 budget.

Allow the following expenses as deductions from an individual’s Adjusted Gross Income:

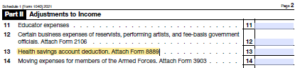

- Educator Expenses

- Information can be found on IRS Schedule 1 (Form 1040) in Part II Adjustments to Income.

- To receive the educator expense the individual must be an eligible educator. An eligible educator is a full time teacher of kindergarten through twelfth grade. Half-time, part-time, or homeschool teachers do not qualify for an educator expense deduction.

- An eligible educator can deduct up to $250 per tax year of qualified expenses. If married and both spouses are eligible educators, they can deduct up to $500 per tax year of qualified expenses. However, neither spouse can deduct more than their own expense, up to $250.

- Qualified educator expenses include materials used in a classroom such as: books, supplies, and equipment (computers, software and services). Home schooling supplies and non-athletic supplies for physical education or health classes are not qualified expenses.

- Certain Business Expenses of Reservists, Performing Artists, and Free-Basis Government Officials

- Information can be found on IRS Schedule 1 (Form-1040) in Part II Adjustments to Income.

- Certain business expenses of National Guard and reserve members who traveled more than 100 miles from home (one-way) and stayed overnight to perform services as a National Guard or reserve member;

- Performing arts-related expenses as a qualified performing artist; and

- Business expenses of fee-basis state or local government officials.

- Health Savings Account (HSA) Deduction

- Information can be found on IRS Schedule 1 (Form-1040) in Part II Adjustments to Income.

NOTE: This is different from the HSA pre-tax deduction. This amount is based on Form 8889, not the individual’s pay stub.

-

- A deduction for contributions made from a person’s income to a qualified HSA during the year.

- Contribution maximum amounts made to an HSA are limited by the IRS and vary depending on if the coverage is self-only or family coverage. In common situations:

Maximum Annual HSA Contributions 2020 2021 2022 Self-Only Coverage $3550 $3600 $3650 Family Coverage $7100 $7200 $7300 - Individuals age of 55 or older at the end of the tax year are allowed a higher limit, the contribution limit based on type (self or family) of coverage will increase by $1000 annually.

- Reminder: limits change annually and should be reviewed based on the particular tax year limit.

- See: Publications 969 for the particular tax year.

- Archer Medical Spending Account (MSA) Deduction

-

- Send an IM-14 using the appropriate supervisory channels

- Moving Expense (ONLY for certain Armed Forces Members)

- Information can be found on IRS Schedule 1 (Form-1040) in Part II Adjustments to Income.

- Costs of moving can be deducted if the individual is a member of the Armed Forces on active duty and due to a military order move because of a permanent change of station.

- The standard mileage rate for using your vehicle to move to a new home is 18 cents a mile.

- The deduction is for reasonable unreimbursed expenses of moving

- Moving household goods and personal effects, and

- Travel

- Self-Employed SEP, SIMPLE, and Qualified Plans

- Information can be found on IRS Schedule 1 (Form-1040) in Part II Adjustments to Income.

- A deduction for contributions to a qualified retirement plan for the self-employed and clergy members.

- Send an IM-14 through normal supervisory channels if deductions are questionable.

- Self-Employed Health Insurance Deduction

- Information can be found on IRS Schedule 1 (Form-1040) in Part II Adjustments to Income.

NOTE: This is based on forms; Schedule C, C-EZ, or F

-

- Amount paid for health insurance when an individual is self-employed.

- This deduction may include the expense paid for the self-employed individual, and the individual’s; spouse, children (under the age of 27 at the end of the tax year) and tax dependents.

- The insurance plan must be established under the self-employment business.

NOTE: If the self-employed individual is enrolled under a spouse’s health insurance plan (or any other health insurance plan other than under the business), do not use the amount paid for health insurance.

- Penalties on Early Withdrawal of Savings

-

- Information can be found on IRS Schedule 1 (Form-1040) in Part II Adjustments to Income.

- A deduction for penalties paid for early withdrawal of savings from certain financial accounts.

- Alimony Paid

- Information can be found on IRS Schedule 1 (Form-1040) in Part II Adjustments to Income.

- A deduction for payments to or for a spouse or former spouse under a divorce or separation agreement finalized prior to January 01, 2019 and no changes made to the agreement after January 01, 2019.

- Contributions to Individual Retirement Accounts (IRA’s)

- Information can be found on IRS Schedule 1

- (Form-1040) in Part II Adjustments to Income.

- Contributions made to a traditional IRA during the taxable year may be deducted.

- The person must have earnings in the year to qualify for the deduction.

NOTE: This does not include contributions to Roth IRAs.

-

- General limit: $5,500 ($6,500 if age 50 or older) annual contribution

- Student Loan Interest Deduction

- A qualified student loan is defined as any loan taken out to pay qualified higher education expenses for any of the following people:

- The individual or their spouse.

- The individual’s tax dependent.

- Any person the individual could have claimed as a tax dependent but did not because of one of the following:

- The person filed a joint tax return with someone other than the tax filer paying the qualified student loan interest.

- The person had gross income that was equal to or more than the exemption amount for that particular tax year.

- The individual or their spouse could be claimed as a tax dependent by another person.

- A student loan is not considered qualified when:

- Any of the proceeds of the loan were used for purposes other than the qualified higher education expenses,

- The loan proceeds were borrowed from a relative, or

- The loan proceeds were borrowed from a qualified employer plan.

- The individual does not have to be a student in the current tax year.

- Information can be found on IRS Schedule 1 (Form-1040)(Form-1040) in Part II Adjustments to Income.

- A person may take this deduction if all of the following apply:

- The person paid interest in the taxable year on a qualified student loan;

- The person’s filing status is any status except married filing separately;

- The person’s modified adjusted gross income is less than the allowable amount as listed in the instructions for Form 1040. This amount is subject to change each year. Review the Form 1040 Instructions to find the allowable amount for the applicable year. The instructions can be found at www.irs.gov, Forms, Instructions & Publications.

- The person is not claimed as a dependent on someone else’s tax return.

- A qualified student loan is defined as any loan taken out to pay qualified higher education expenses for any of the following people:

- Deductible Part of Self-Employment Tax

-

- Information can be found on IRS Form 1040, – of Schedule 1.

- The deductible amount of self-employment tax owed by an individual for their self-employment business.

NOTE: This is based on the IRS Schedule SE (Self-Employment Tax) Form-1040.

Manual Income Calculations with Deductions

For both pre-tax and deductions that are adjustments to income:

- Enter in gross wages, and

- Use available selections within the eligibility system to enter deductions

- Only enter deductions allowable under MAGI guidelines

- The eligibility system will subtract the deductions from the gross income

- If circumstances require a manual calculation of deductions, include notes to explain all manual calculations.

Although the eligibility system calculates the income after subtracting deductions, it is necessary to understand how to manually calculate income with deductions.

EXAMPLE: Jan is employed and is paid semi-monthly (twice per month) a salaried amount of $1,716.00. Jan’s pre-tax deductions were not RC with the electronic sources. She provided her pay stubs to verify her pre-tax deductions which include: health, vision, and dental insurance for herself, her spouse and children, and contributions to her deferred compensation plan. Jan does not claim any other deductions. To calculate Jan’s MAGI income, convert her income and deductions into monthly amounts and then subtract her deductions from her gross pay. Review Jan’s pay stub below to identify her gross pay and pre-tax deductions.

- Convert Jan’s income to reflect her monthly gross salary.

- $1,716.00 x 2 = $3,432.00

- Convert Jan’s pre-tax deductions to monthly amounts.

- Dental Insurance $43.94 x 2 = $87.88

- Health Insurance $44.50 x 2 = $89.00

- Vision Insurance $7.89 x 2 = 15.78

- Medical Cafeteria Plan $75.00 x 2 = $150.00

- Deferred Comp Contribution $37.50 x 2 = $75.00

- Total Monthly Deductions = $417.66

Outcome: Jan’s household MAGI income, after pre-tax deductions, is $3,014.34 ($3,432.00 – $417.66 = $3,014.34)

EXAMPLE: Jon applies for MAGI Family MO HealthNet (MHN) for his 8-year-old daughter, Hazel, who he expects to claim as a dependent. Jon is an elementary school teacher. His monthly gross income is $2,250. He spent $240 on supplies for his classroom (Educator Expense Deduction) in the taxable year. Hazel’s MAGI-based household size is herself and her father, Jon. To manually calculate Jon’s income, and Hazel’s MAGI household income, divide the Educator Expense by 12 months ($240 / 12 = $20), and subtract that amount from the MAGI household income ($2,250 – $20 = $2,230). The monthly MAGI household income is $2,230.