IM-30 April 3, 2023; IM-100 July 11, 2022; IM-94 June 30, 2022; IM-39 March 15, 2019; IM-96 July 13, 2017; IM-46 May 12, 2017; IM-07 January 27, 2017; IM-97 November 9, 2015

Definitions

Reasonable Compatibility (RC) is defined as the allowable difference between the self-attested income and the income reported by the electronically obtained information (EOI). RC is used to determine if further clarification is required from the participant to verify the self-attested income.

A program threshold is the maximum income limit for the Title XIX or CHIP program.

An eligibility level is a point of eligibility within a program threshold. For example, CHIP 73 and 74 are eligibility levels within the CHIP program threshold. MO HealthNet for Families (MHF) and Adult Expansion Group (AEG) are eligibility levels within the Title XIX Medicaid program threshold.

RC Process

Reasonable Compatibility policy is only applied when the attested income is below the threshold and the electronic verification is above the threshold. All other scenarios do not require additional clarification.

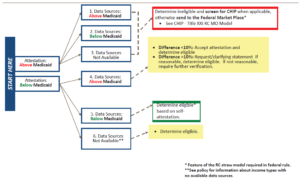

Below is an illustration of the process for applying RC in a Medicaid-Title XIX eligibility determination. Scenario #4 below explains when to apply the 10% RC test.

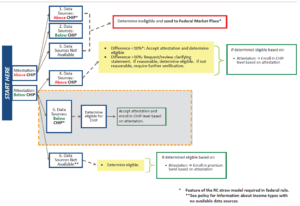

Below is an illustration of the process for Applying RC in a CHIP eligibility determination. Scenario #4 below explains when to apply the 10% RC test.

Applying Reasonable Compatibility

To determine if the income is RC, gather the following information:

- household size

- MHN program’s income eligibility levels and program thresholds

- self-attested income

- electronic data source income

- Determine which program thresholds apply to the participant.

Apply the highest threshold level based on potential program eligibility.

Example: Mary applied for MHN and reports a pregnancy. Explore eligibility for MO HealthNet for Pregnant Women (MPW); if ineligible for MPW, explore eligibility for Show Me Healthy Babies (SMHB) in the CHIP threshold.

Example: Mary applied for MO HealthNet (MHN). She is the only person in the home and would only be eligible for AEG. Explore eligibility for AEG coverage in the Title XIX Program Threshold.

Example: Scott applied for MHN for his two uninsured children. Eligibility for them is explored in both the Title XIX and CHIP program thresholds.

- Compare self-attested income to available EOI.

Refer to the RC flow charts above for Title XIX Medicaid or CHIP.

Income is not RC

Incomes are not RC when:

- The self-attested income is below the program threshold and EOI is higher than the program threshold. See scenario #4 in the RC flow chart.

- Determine if the difference between the attested income and the EOI is less than or greater than 10%

- If the difference is less than 10% accept the attested income and determine eligibility.

- If the difference is greater than 10% attempt a phone call to clarify the information. If the explanation is reasonable, comment in the system and determine eligibility.

- If the explanation is not reasonable, or you cannot reach the person by phone, a Request for Information should be sent asking for clarification of the difference between the attested and EOI incomes.

Clarifying Statement from the Participant and Verification

A clarifying statement can consist of a phone, face to face or written statement that reasonably explains the difference in the income amounts between self-attested and EOI. Reasonable explanations might include overtime, raises or bonuses not included in the self-attested income but reported by the employer and shows in the EOI data. Refer to 1805.030.05 Income Evidence for acceptable verification.

EOI is not Available

Some income types do not have an electronic data source to search for EOI, other than income verified for another assistance program such as SNAP. After checking other assistance programs for verification, accept the self-attested amount of income for the following income types:

- Self-employment (including farm income)

- Pensions

- Short or long-term disability

MHN Thresholds and Eligibility Levels

| Title XIX Program Threshold | CHIP Program Threshold | State-Only Program Threshold |

| Adult-Eligibility Levels | Adult-Eligibility Levels | Adult |

| MHF-MHF income limit for household size. |

SMHB-150%–300% of the FPL |

UWHS—201% of the FPL |

| AEG for adults 19 through age 64-133% of the FPL | Kids-Eligibility Levels | |

| MPW-196% of the FPL | CHIP 4M-age 1 through age 18—153% of the FPL Eligibility for CHIP 4M for ages 6 through 18 starts at 110% of the FPL | |

| Kids-Eligibility Levels | CHIP 71/72—150% of the FPL | |

| Children under the age of 1-196% of the FPL | CHIP 73-185% of the FPL | |

| MHK for children age 1 through age 18 148% of the FPL | CHIP 74-225% of the FPL | |

| CHIP 75-300% of the FPL |