FROM: KIM EVANS, DIRECTOR

SUBJECT: COVID-19 TEMPORARY UPDATES TO THE TEMPORARY ASSISTANCE (TA) PROGRAM

DISCUSSION:

On March 13, 2020, a national health emergency was declared in response to COVID-19. Due to this emergency, the Family Support Division (FSD) recognizes that some Temporary Assistance (TA) eligibility factors may be difficult to satisfy due to unavailability or other hardships. Below are three (3) temporary policy updates being implemented to assist TA applicant/participants.

45 Month Lifetime Limit Extension

FSD is extending TA benefits to Forty Eight (48) months through Hardship Extensions. Any participant that is due to close for meeting the Forty Five (45) month Lifetime Limit and do not qualify for any exemptions during the months of March, April and May 2020 will receive the Hardship Extension.

Hardship Extensions will be completed through system updates for all currently active participants that have reached or will reach their 45-month lifetime limit in the months of March, April, and May 2020. The COMPACT screen will be updated to show these participants as J-“Hardship extension referred to MWA” in the “Work Req Ind” field and 25-“Family Crisis” in the “Extension Rsn” field. These will have a re-evaluation date of 05/15/20.

FSD staff processing TA applications received March 1 – May 31, 2020 will follow normal procedures when a client may be eligible for this hardship extension with the exception of the temporary changes below due to the COVID019 crisis:

- FSD staff will enter a re-evaluation date of 3 days following the date the case is taken through CONFLOWS. (Refer to the CRG under Lifetime Limit for current process).

- When completing the IM-2EH for this hardship extension you will mark Family Crisis and enter in the explanation: COVID19, client has reached their 45-month lifetime limit.

- All requests for an extension will continue to be sent to the TA/CC processing center at GROUP E, FSD. Only those who are currently responsible for determining extension eligibility will enter the information on the COMPACT screen regarding the COVID 19 extension and will enter a comment about the action using COVID19 in the title for the comment.

- The codes being used are J-“Hardship extension referred to MWA” in the “Work Req Ind” field and 25-“Family Crisis” in the “extension rsn” field on the COMPACT screen. These hardship extensions are for the months of March, April and May 2020.

This update will be re-evaluated at the end of May.

Drug Testing and Drug Treatment Referrals

FSD is suspending all mandatory drug testing and treatment referrals. FSD staff will not change any process in entering an application in the Family Assistance Management Information System (FAMIS) based on the clients’ answers to the drug test screening question and the waiver for drug treatment in lieu of a drug test question.

FSD staff will continue to follow TA Policy, 0240.000.00 Temporary Assistance Drug Test Requirements. Participants that are mandatory for drug testing or treatment will still be referred after the COVID-19 Health Emergency is over.

Participants that received the following disqualifications with a violation date of 03/01/20 were end dated with code of SNI – “Sanction Not Imposed”.

DNS – DID NOT SHOW UP FOR DRUG TEST

6NS – DID NOT SHOW-UP FOR DRUG TEST-6 MOS

TRP – FAILURE TO PARTICIPATE IN MANDATORY TREATMENT

These participants will be re-referred to start the process over once the COVID-19 crisis is over.

This update will be re-evaluated at the end of May.

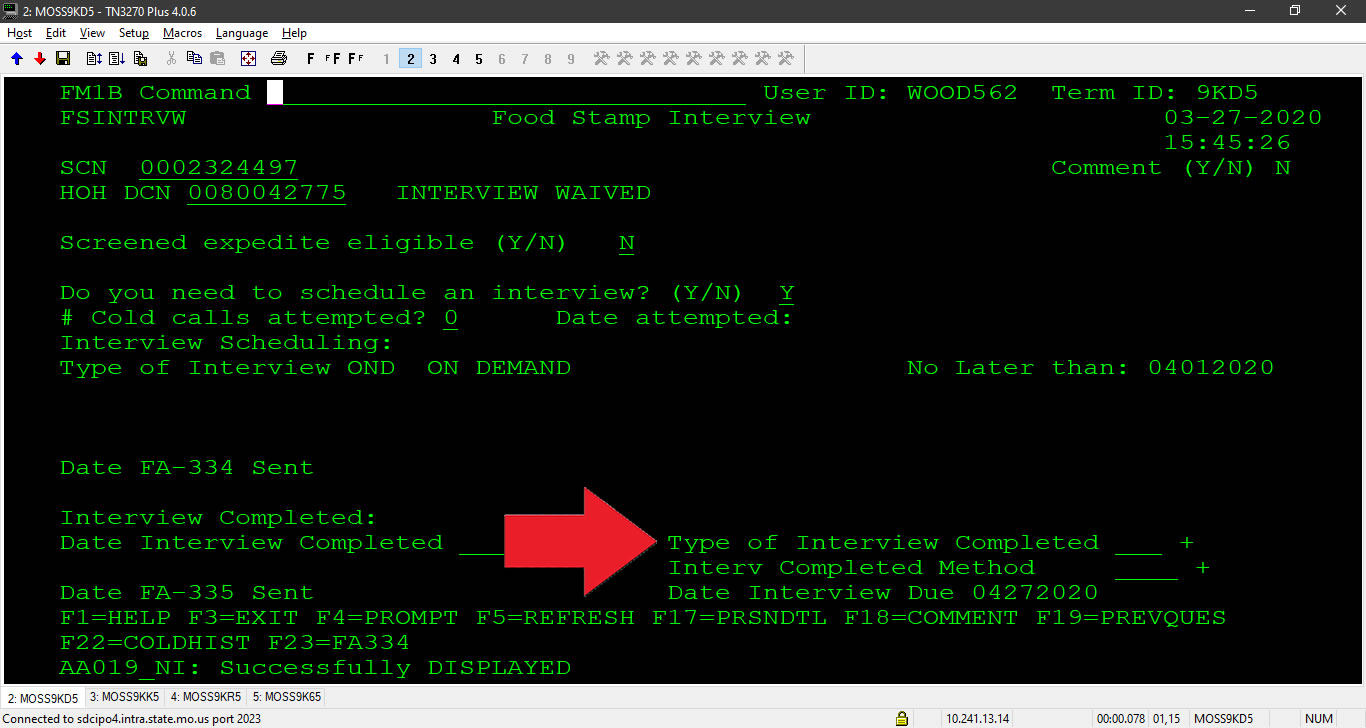

MWA Work Requirements

FSD is suspending MWA work requirements for TA participants for 90 days. In addition, the completion of the TA Orientation and Personal Responsibility Plan (PRP) is waived for the length of time in which the work requirement is suspended.

- Any actions to reduce benefits or close for WR5 or WRF sanctions will be put on hold during the suspension.

- FSD referrals will continue to be sent and MWA contractors will still attempt to engage the participants.

- There will be a temporary change in the initial contact appointment letter sent by the MWA contractors to offer services during the COVID-19 crisis but not require their immediate participation. The goal in taking this action is that we will be able to continue to provide supportive services to those participants who are able to engage in work activities while ensuring that those participants who are not able to actively engage encounter no negative effects during this time.

- FSD staff should continue their usual coding for recipients on the COMPACT screen with the exception of the Orientation/PRP field. A new code CD- “Waived Due to COVID-19” has been added to this field in order to waive the TA Orientation and PRP at this time.

Those cases that are for WRF sanctioned applicants should continue to be referred. There are no changes for FSD Staff in FAMIS. The MWA contractors will implement a process that will ensure sanctioned applicant cases are not rejected due to not completing the needed hours.

ITSD will be prohibiting any work requirement case sanctions (codes WR5 or WRF) from being activated in FAMIS during the specified time period. FSD staff are instructed to not act to end or delete any of these sanctions in FAMIS at this time.

The work requirement will be re-evaluated at the end of May.

NECESSARY ACTION:

- Review this memorandum with appropriate staff.

- Follow above instructions starting immediately.

KE/hrp/ph/ejf/jp