Department of Social Services

Family Support Division

PO Box 2320

Jefferson City, Missouri

TO: ALL FAMILY SUPPORT OFFICES

FROM: KIM EVANS, DIRECTOR

SUBJECT: COVID-19: UNEMPLOYMENT COMPENSATION UPDATES RESULTING FROM THE CONSOLIDATED APPROPRIATIONS ACT, 2021

DISCUSSION:

Memo IM-37, dated April 29, 2020, introduced 3 new types of Unemployment Compensation funds that were created on March 27, 2020, as a result the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Those funds were the Federal Pandemic Unemployment Compensation (FPUC) fund, the Pandemic Unemployment Assistance (PUA) fund, and the Pandemic Emergency Unemployment Compensation (PEUC) fund.

On December 27, 2020, the Consolidated Appropriations Act, 2021 (CAA) was signed into law. The CAA enacts changes to the provisions of unemployment funds introduced by the CARES Act:

- FPUC-A $300 weekly federal supplement is added to regular unemployment funds starting after December 26, 2020 and ending March 14, 2021. FPUC funds are excluded/non-countable income for the Supplemental Nutrition Assistance Program (SNAP) and all MO HealthNet programs (except for sighted spouses on Blind Pension determinations).

- PUA funds provide unemployment benefits for eligible individuals who are self-employed, seeking part-time employment, or who would not otherwise qualify for Unemployment Compensation. PUA funds are extended through March 14, 2021 and allow certain individuals to continue receiving benefits through April 5, 2021. These funds count for all programs.

- PEUC funds provide an additional 13 weeks of unemployment benefits to individuals who have exhausted benefits under regular Unemployment Compensation. PEUC funds are extended through March 14, 2021 and allow certain individuals to continue receiving benefits through April 5, 2021. These funds count for all programs.

IMES is updated to include all three types of Unemployment.

Verification of Unemployment Compensation Income

Use IMES to identify, budget, and verify gross income and deductions from Unemployment Compensation for Missouri unemployment recipients.

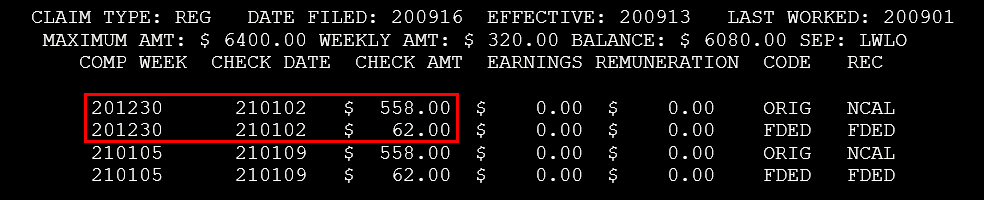

- Review the COMP WEEK column of the IMES. Total all payments made per the CHECK AMT column for each specific COMP WEEK date to determine a gross payment amount. In the red box below, the total payment made for the COMP WEEK 12/30 is $620.00 ($558 + $62=$620).

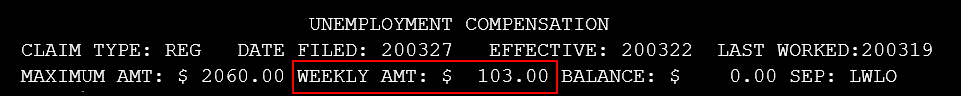

- Review the WEEKLY AMT field to determine the regular weekly amount.

- Enter the WEEKLY AMT as regular unemployment, PUA, or PEUC funds.

NOTE: Refer to 2020 Hot Tip, Identifying Pandemic Unemployment Types on IMES for more.

The remaining amount, should be the $300 FPUC funds. Enter this amount as FPUC.

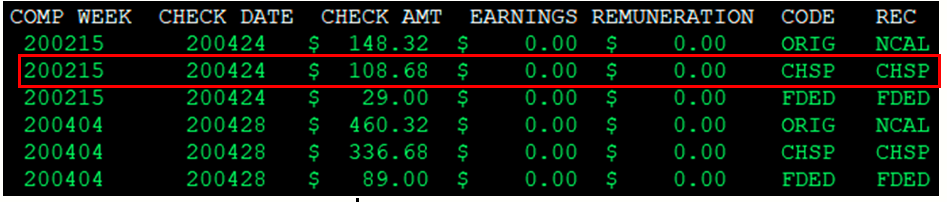

- For FAMIS determinations, evaluate the REC column of the IMES for child support payments (CHSP). If child support payments are deducted, budget the payments on the Court Ordered Expense (SUPEXP/FMXL) screen in FAMIS using normal budgeting procedures.

- Review the budget screens in the eligibility system before authorization. Regular Unemployment Compensation/Insurance is included income for all programs.

Refer participants with questions about Unemployment Compensation to the Missouri Department of Labor and Industrial Relations interactive site at uinteract.labor.mo.gov. Participants can use this site to file claims for Unemployment Compensation, view income verification, request documentation, and report changes in circumstances.

NECESSARY ACTION:

- Review this memorandum with appropriate staff.

KE/ers/hrp/mm/sb/nw