Department of Social Services

Family Support Division

PO Box 2320

Jefferson City, Missouri

TO: ALL FAMILY SUPPORT OFFICES

FROM: KIM EVANS, DIRECTOR

SUBJECT: COVID-19: MIXED EARNER UNEMPLOYMENT COMPENSATION (MEUC) BENEFITS FOR ALL PROGRAMS

DISCUSSION:

On 12/27/2020, the Consolidated Appropriations Act (CAA) 2021 was signed. The CAA contains provisions to address the public health emergency (PHE) and introduced MEUC, a new type of unemployment compensation.

MEUC provides a $100 weekly benefit to individuals with combined earnings from regular employment and self-employment. MEUC can be received in combination with all other unemployment compensation types except for Pandemic Unemployment Assistance (PUA).

The American Rescue Plan Act of 2021 was signed into law on March 11, 2021. This act extended several temporary unemployment compensation types, including MEUC, until September 6, 2021.

See IM-02 COVID-19 Unemployment Compensation Updates Resulting From The Consolidated Appropriations Act, 2021 for information on other types of unemployment compensation.

All Programs

Include/count payments from MEUC for ALL Income Maintenance programs including MO HealthNet, Supplemental Nutrition Assistance Program, Temporary Assistance, and Child Care.

Important

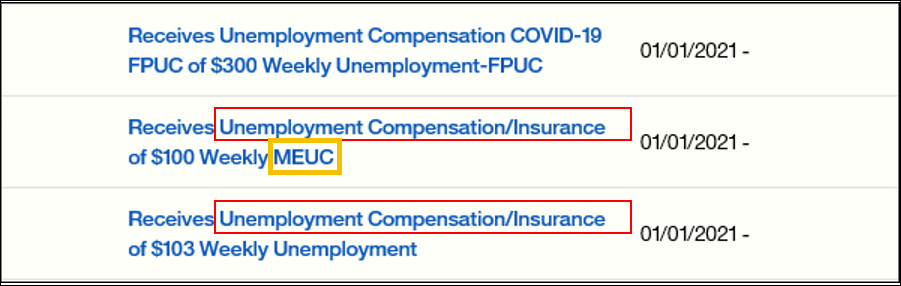

No new income type was created for MEUC funds. Enter MEUC using existing income selections for regular unemployment compensation. Entries for Source Name Field in FAMIS and Employer Name field in MEDES must be exact:

- In FAMIS, enter the gross income as unearned income (UI) and select UC-Unemployment Compensation/Insurance. In the Source Name Field, type MEUC.

- Continue to make appropriate entries on Court Ordered Expense (FMXL/SUPEXP) to indicate child support expenses.

- In MEDES, select Unemployment Compensation/Insurance and enter the gross income. In the Employer Name field, type MEUC.

Income Entry

If regular unemployment compensation or another type of unemployment compensation is received in conjunction with MEUC, add each type as a separate income entry.

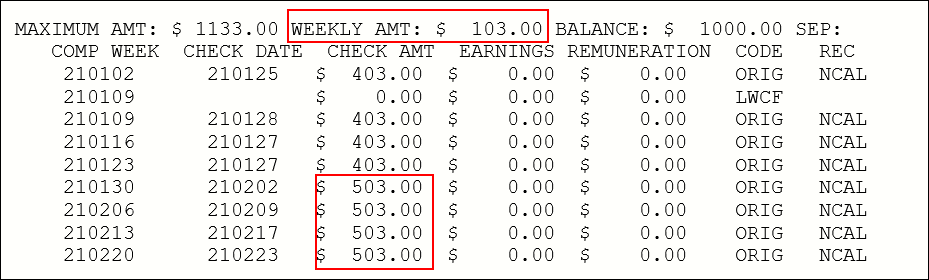

In the example below, the participant receives a gross amount of $503 per week-

- The regular weekly amount is $103, which should be entered as regular unemployment.

- After deducting $103 in regular unemployment, $400 remains. $300 should be entered as FPUC.

- The remaining $100 should be entered as regular unemployment, with MEUC as the income source name.

This case will have 3 income entries; 2 of them will look like a regular Unemployment Compensation selection:

- FAMIS

- MEDES

Prior Quarter

Payments from MEUC were not made prior to the week ending March 6, 2021. Do not budget income from MEUC for months prior to March 2021.

NOTE: For Family MO HealthNet cases, use IMES to support self-attested income in reasonable compatibility decisions for countable unemployment compensation types, as outlined in the MEDES COVID-19 Self Attestation Guide.

NECESSARY ACTION:

- Review this memorandum with appropriate staff.

KE/ers