FROM: KIM EVANS, DIRECTOR

SUBJECT: INTRODUCING DECEASED MATCHES SECTION TO THE SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM (SNAP) MANUAL

MANUAL REVISION #

1141.010.05

DISCUSSION:

In order to prevent deceased individuals from receiving SNAP benefits, the agency compares SNAP household member data against information received in the Social Security Administration’s (SSA) Master Death File. When a match is found, a Notice of Match Result (NOMR/FA-601) is sent by the eligibility system informing the household of the match.

The NOMR allows 10 days for the SNAP household to respond and/or dispute the match. After 10 days if the household does not respond to the NOMR or if the household responds but fails to provide enough information to clarify the circumstances, death details are populated on the Birth/Death Information (BIRTH/FMAQ) screen in FAMIS and a notice of adverse action (NOAA) is system generated. At the end of the adverse action period, the matched individual will be removed from the household and benefits will be adjusted accordingly.

Note: An entire SNAP case should not be closed for failing to respond to the NOMR unless the individual matched is the only household member or the matched member is the head of the SNAP household.

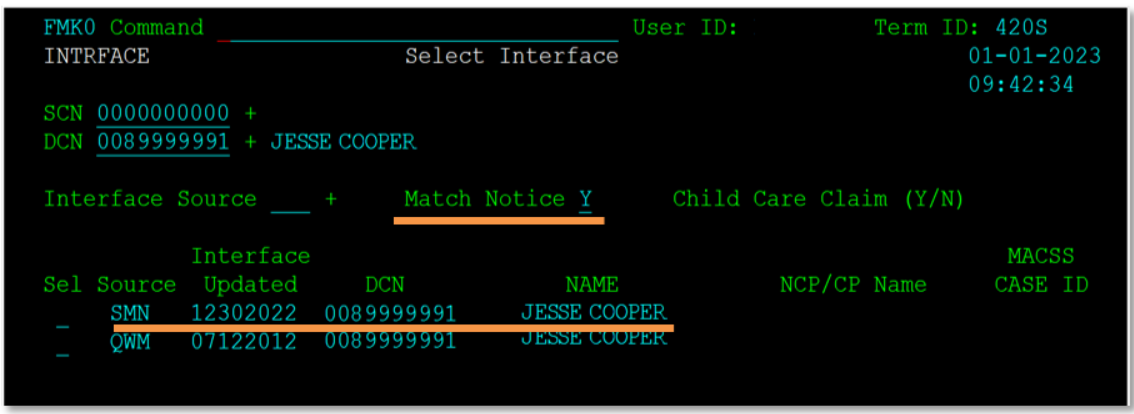

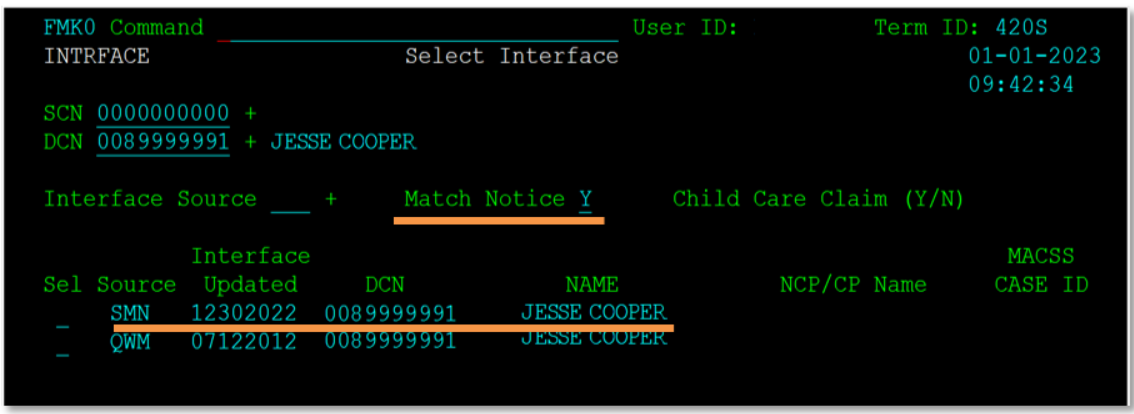

A new Match Notice field will display “Y” on Select Interface (INTRFACE/FMK0) screen in FAMIS if an individual is matched with the SSA’s Master Death File.

Note: SMN stands for SNAP Match Notice on Select Interface

If a mismatch can be proven, the Match Notice field should be updated to “N” once a participant has provided verification. If the date of death has already been entered by the system, it will need to be removed should the participant provide proof that the household member is not deceased and any actions taken by the system will need to be corrected.

The NOMR is only sent and the Match Notice indicator will only show a match for cases with active SNAP participation. Child Care, Temporary Assistance, or MO HealthNet cases will only show the SMN and Match Notice indicator when the matched participant is also active on a SNAP case. For all non-SNAP cases, the eligibility system will populate the death information on BIRTH (FMAQ) screen once a match is found with the SSA’s Master Death File, and the process to close or remove benefits for the individual will begin without the NOMR.

NECESSARY ACTION:

- Review this memorandum with appropriate staff.

KE/tl